RealTax

Accounting & Tax Time Simplified!

We make it quick, easy and affordable.

Services

What we do?

Individuals

Tax Return

Preparing your own tax return can be confusing, frustrating, and time-consuming. Additionally, tax laws are complicated and difficult to understand…

Accounting Consulting

This involves providing clients with the support and advice they need to make business decision…

Tax Problems

The last thing anyone wants is to hear that they have a problem with the CRA. However, the truth is that it happens, and when it does, you can find yourself in a very stressful and costly situation…

Corporation

Bookkeeping

Bookkeeping refers to the daily recording of a company’s financial transactions and it is integral to the success of any business…

New Business Formation

Setting up your business requires careful planning. You will need to create and modify your business plan…

Financial Statements

Setting up your business requires careful planning. You will need to create and modify your business plan, complete the legal paperwork…

CRA Appeals

Interpretations of tax laws or documentation issues could lead to problems with the assessment issued by the CRA…

Our Numbers

Successful Accomplishments

+ 1.500

Corporate Tax Returns

Services provided

Personal Tax Returns

File your Tax Return with us now!

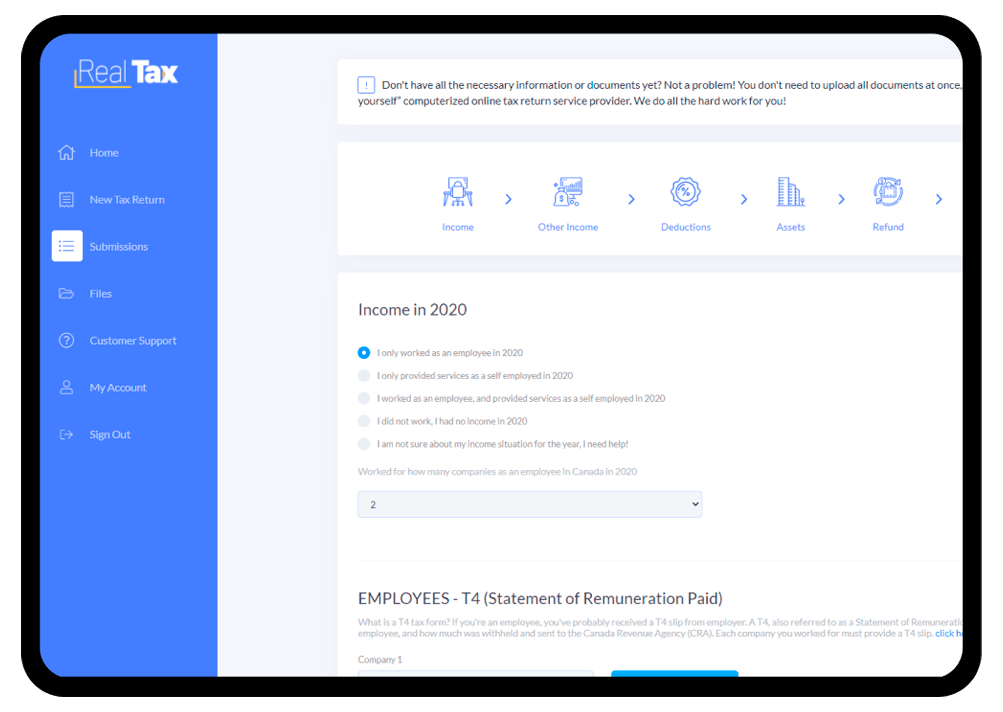

How it Works

Register

Register

Simply fill out our online form.

Uploads

Uploads

Upload all the necessary information and documents. We will start your tax preparation process.

Ready

Ready

Everything is done! You will be contacted by our tax expert shortly.

We make it Affordable.

Pricing

Individuals

Basic*

- Included:

- – Initial Orientation (Upon Request).

- – Tax Return Preparation (Canadian Income only) is limited to: Income Slips: T4, T4E, T5, T3, T2202 / Deductions: Donation, RRSP, Childcare Expenses and Medical Expenses (Up to 8 deduction Receipts or slips).

- – PDF of the complete tax return is available for download and emailed to the customer.

- – Benefit Application, GST/Ontario Trillium (New or Existing Residents of Canada).

- ____

- NOT Included:

- – T1135 – Foreign Declaration.

- – Free Individual consulting /Meeting to explain tax results.

- – Sale of property in Canada or Abroad.

- – Free Support in case of an audit by the Canada Revenue Agency (CRA).

- – Home office detailed or simplified Version.

- – First Time Home Buyer Credit.

- – Moving Expenses.

- – Other Income or deduction not listed above.

- – Free assistance in other areas, such as Benefits, Planning, Business Formation, etc.

Intermediate*

- Included:

- – Initial Orientation (Upon Request).

- – Tax Return Preparation (Canadian Income only) is limited to: Income Slips: T4, T4E, T5, T3, T2202 / Deductions: Donation, RRSP, Childcare Expenses and Medical Expenses (Not limited).

- – PDF of the complete tax return is available for download and emailed to the customer.

- – Benefit Application, GST/Ontario Trillium (New or Existing Residents of Canada).

- – T1135 Foreign Declaration Simplified Version (Total Assets Up to CAD 250,000).

- – Home office detailed or simplified Version.

- – First Time Home Buyer Credit.

- – Free Support in case of an audit by the Canada Revenue Agency (CRA).

- __

- NOT Included:

- – Free assistance in other areas, such as Benefits, Planning, Business Formation, etc.

- – Moving Expenses.

- – Sale of property in Canada or Abroad.

- – Free Individual consulting /Meeting to explain tax results.

Plus*

- Included:

- – Initial Orientation (Upon Request).

- – Tax Return Preparation (Canadian Income only) is limited to: Income Slips: T4, T4E, T5, T3, T2202 / Deductions: Donation, RRSP, Childcare Expenses and Medical Expenses (Not limited).

- – PDF of the complete tax return is available for download and emailed to the customer.

- – Benefit Application, GST/Ontario Trillium (New or Existing Residents of Canada).

- – T1135 Foreign Declaration Simplified Detailed ( Total Assets Above $CAD 250,000).

- – Home office detailed Version.

- – First Time Home Buyer Credit.

- – Free Support in case of an audit by the Canada Revenue Agency (CRA).

- – Moving Expenses.

- – Sale of property in Canada or Abroad

- – Free Individual consulting /Meeting to explain tax results (Upon Request– Up to 15 minutes).

- – 1 rental income (property in Canada).

- ___

- NOT Included:

- – Free assistance in other areas, such as Benefits, Planning, Business Formation, etc.

*Based on complexity and tax situation the final service fee may be different from the estimated amount.

Self-employed

Self-Basic*

- Included:

- – Initial Orientation (Upon Request).

- – Tax Return Preparation for self employed (Ride sharing – Uber, Lyft etc, gross sales up to CAD$30,000 – Real Tax Self Employed Worksheet must be filled out or total sales and expenses summary sent by the client) Bookkeeping and GST report not included.

- Other Canadian Income is limited to: Income Slips: T4, T4E, T5, T3, T2202 / Deductions: Donation, RRSP, Childcare Expenses and Medical Expenses (Up to 8 deduction Receipts or slips).

- – Home office simplified Version.

- – PDF of the complete tax return is available for download and emailed to the customer.

- – Benefit Application, GST/Ontario Trillium (New or Existing Residents of Canada).

- ___

- NOT Included:

- – T1135 – Foreign Declaration.

- – Free Individual consulting /Meeting to explain tax results.

- – Sale of property in Canada or Abroad.

- – Free Support in case of an audit by the Canada Revenue Agency (CRA).

- – Home office detailed Version.

- – First Time Home Buyer Credit.

Self-Plus*

- Included:

- – Initial Orientation (Upon Request).

- – Tax Return Preparation for self employed (Ride sharing – Uber, Lyft etc, Real Tax Self Employed Worksheet must be filled out or total sales and expenses summary sent by the client) GST report included, Bookkeeping not included.

- Other Canadian Income is limited to: Income Slips: T4, T4E, T5, T3, T2202 / Deductions: Donation, RRSP, Childcare Expenses and Medical Expenses (Not limited).

- – Home office simplified or detailed Version.

- – PDF of the complete tax return is available for download and emailed to the customer.

- – Benefit Application, GST/Ontario Trillium (New or Existing Residents of Canada).

- – T1135 Foreign Declaration Simplified Version (Total Assets Up to CAD 250,000).

- – First Time Home Buyer Credit.

- – Free Support in case of an audit by the Canada Revenue Agency (CRA).

- – Free Individual consulting /Meeting to explain tax results (Upon Request– Up to 15 minutes).

- ___

- NOT Included:

- – Free assistance in other areas, such as Benefits, Planning, Business Formation, etc.

- – Moving Expenses.

- – Sale of property in Canada or Abroad.

Others*

Price on request- – Consulting.

- – Partnerships tax return or registration.

- – Bookkeeping for tax return preparation.

- – GST Filing :Backdate or late.

- – PST Filing.

- – Review of Declaration already submitted.

- – Payroll Report for Sole Proprietors.

- – T4 preparation and filing.

- – Tax Return for Non Residents.

- – Custom Accounting Services.

- – Rental Income report.

*Based on complexity and tax situation the final service fee may be different from the estimated amount.

Corporation

Tax Consulting

Starts at:

Corporation Registration

Starts at:

Self-employed Registration

Starts at:

Business Flat Fee

Starts at:

$125/month

GST/HST/PST/Worksafe Registration

Starts at:

$150

Payroll

Starts at:

$75

* Based on complexity and tax situation the final service fee may be different from the estimated amount.

About us

Meet Our Team

Real Tax is a fast growing public accounting firm focused on the needs of small companies – startups and individuals. We’re located in the heart of Downtown – Vancouver, British Columbia. At Real Tax, we believe that without accounting, life will be bleak, as in both the personal and corporate worlds, effective accounting allows one to review the past and the present in order to prepare for the future. Essentially, it keeps you in good health, fiscally speaking at least.

We all have unique accounting needs. Small and medium business owners need to place profound attention on accounting. Our staff are experienced and from diverse backgrounds. This experience and diversity enables us to easily relate to your accounting needs like bookkeeping; tax preparation and consulting; payroll management and financial statements (among others). We want you to be more than just another client.

We want to be a part of your story, forging bonds with your company and tailoring our services to your company’s philosophy. For us, working with our clients is never quite “work.” It’s more like helping out a friend or loved one. That’s Real Tax for you!

If you are looking for accounting solutions with a personalized, homely touch, then you are in the right place.

Videos

Check out our Accounting Tips and Tools for help

Materials

Check out our Tools for help

Are you a self-employed contractor or other unincorporated business? Please feel free to use our Business Income and Expenses Worksheet to compile your business income and expenses for the year. Once you’ve entered your information, the Excel spreadsheet can easily be sent to us to help us prepare your personal tax return which includes your business.

If you are a GST/HST Registrant, these worksheets will help you summarize your GST or HST data for quarterly and annual report filings.

Portuguese

Portuguese English

English